kern county property tax assessor

New Fees for Vital Records as of January 1 2022. Enter Any Address Find Previous Property Owner Records for Your State.

California Public Records Online Directory

The Kern County Assessors Office located in Bakersfield California determines the value of all taxable property in Kern County CA.

. Property tax exemption for senior citizens and people with disabilities. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Your Proposition 13 base value is 266957 and your current market is 145000 for the January.

Access vital information from any internet. Our mission is to collect manage and safeguard public funds to provide community services to the constituents of Kern County and we strive to do this in the most efficient and effective manner possible. Do not enter the street.

Bakersfield California 93301. Visit Treasurer-Tax Collectors site. Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property.

Enter only the street name and optional street number. 2022-2023 Assessed Values can be Found Online. The Kern County Assessor located in Ridgecrest California determines the value of all taxable property in Kern County CA.

One Simple Search Gets You a Comprehensive Bakersfield Property Report. How to Use the Property Search. Restrictive Covenant Modification Affordable Housing is available online.

Assessment Information for Tax Year. Kern County CA Assessor-Recorder Menu. After 5 years of tax -defaulted status defaulted properties become subject to the Power to Sell These properties may be sold at future Internet auctions unless redeemed for the full taxes penalties and other associated.

ASSESSOR 1115 Truxtun Avenue Bakersfield CA 93301 8-5 M-F Except Holidays. 119-086 SOUTHERN KERN UNIFIED. Pregnant belly pictures boy vs girl.

If you are having trouble viewingcompleting the forms you will need to download. Connect from the office home road or around the world. The offices of the Assessor-Recorder Treasurer-Tax Collector Auditor-Controller-County Clerk and the Clerk of the Board have prepared this property tax information site to provide tax payers with an overview of the property tax process in Kern County.

ASSESSOR 1115 Truxtun Avenue Bakersfield CA 93301 8-5 M-F Except Holidays. You can re-assess online or by phone during regular business hours by calling 479 444-1520. They are maintained by various government offices in Kern County California State and at the Federal level.

Personal property like cars boats trailers motorcycles ATVs and livestock must be assessed before May 31st each year. Land Clear APN label Use CD label Neighborhoods Clear Mineral Clear Kern Zoning Clear BFL Zoning Clear Crops Clear Flood Zones Clear Oil Wells Clear AIN Oil Wells Clear. Information about Proposition 19 available from the Office of the Taxpayers Rights Advocate.

Huawei olt 4 port. Please type the text from the image. For each grouped parcel sale parcels will be combined for bidding purposes and sold as one with the one winner being awarded for the entire group.

Assessment Information for Tax Year. Request For Escape Assessment Installment Plan. No CDs to load no concerns about dated information.

Establecer un Plan de Pagos. ASSESSOR 1115 Truxtun Avenue Bakersfield CA 93301 8-5 M-F Except Holidays. Warriors high school.

You may move and load multiple times for more features. Enter an 8 or 9 digit APN number with or without the dashes. Or Proof of Disability Affidavit.

Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property. Exclusions Exemptions Property Tax Relief. Hair salons south reno.

Application for Tax Relief for Military Personnel. See Results in Minutes. Grouped Parcels - there will be 4 grouped parcels offered for sale Mar 16 2022.

Veterans with a 100 disability due to a service-related injury or illness may be eligible to exempt up to 150000 on the assessed value of their home. To our web site. KERN COUNTY ASSESSOR CHANGE OF ADDRESS FORM Please Type or Print Property valuation information and tax bills are mailed to the address contained in Assessors Office records.

Get driving directions to this office. Enter a 10 or 11 digit ATN number with or without the dashes. There are no auctions scheduled at this time.

Our online access to Kern County public records data is the most convenient way to look up Tax Assessor data property characteristics deeds permits fictitious business names and more. We send email notifications to all registered. ASSESSOR 1115 Truxtun Avenue Bakersfield CA 93301 8-5 M-F Except Holidays.

Press enter or click to play code. Supplemental Assessments Supplemental Tax Bills. 661 868 3485 Phone The Kern County Tax Assessors Office is located in Bakersfield California.

Kern county tax assessor property search. It is an honor and a privilege to have the opportunity to serve the taxpayers of Kern County. Pressing a button loads those features in the assessor book at the center of the screen.

Ad Enter Any Address Receive a Comprehensive Property Report. Property tax rates may have risen due to municipalities demanding more money to operate governments or based on higher assessments of properties by the Cook County Assessors Office. Application for Senior Citizen and Disabled Persons Exemption from Real Property Taxes Combined Disposable Income Worksheet.

I received mine in the mail on Saturday and I just about passed out said Dedra Davis of. Business Personal Property. Payment of Property Taxes is handled by the Treasurer-Tax Collectors office.

Handled by the Assessors Office Application to Reapply Erroneous Tax Payment. Enter a partial or complete street name with or without a street number. Hatsune miku bass tabs.

Application for Tax Penalty Relief. Kern county property tax assessor. They are a valuable tool for the real estate industry offering both.

Kern County Assessor GIS. It is the owners responsibility to advise the Assessor when the. Property Tax Important Dates.

Here you will find answers to frequently asked questions and the most. Assessment Information for Tax Year. The Marin County Assessor co-administers the exemptions with the California State Board of Equalization.

It is important that we have your current mailing address to avoid unnecessary delays in delivery. Klinac me tucao a sin gleda. Assessor-Recorder Kern County CA.

California Land Conservation Act Or Williamson Act County Of Fresno

Dickson County Tennessee Property Taxes 2022

City Approves Balanced 33 3 Million Budget News Tehachapinews Com

California Public Records Online Directory

California Public Records Online Directory

Pin By James Kern On Favorite Places Spaces South Florida Fun Florida Vacation Florida Travel

Tulare County Ca Property Tax Search And Records Propertyshark

Get In Touch With Us To Sell Your Land Or Lot

Where Can One Research Property Mineral Rights For California Property Quora

San Benito County Ca Property Tax Search And Records Propertyshark

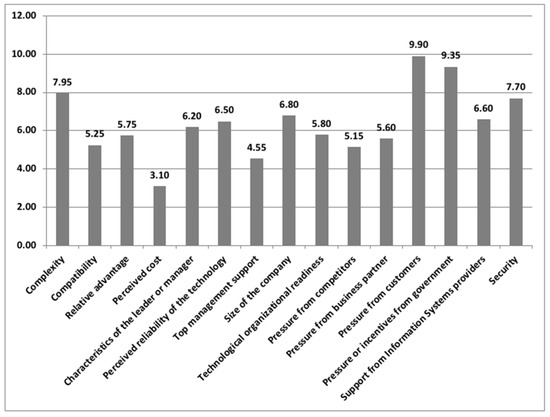

Sustainability Free Full Text Key Factors In The Implementation Of E Proctoring In The Spanish University System Html

Melbourne Fl Big Orange Roadside Attractions Florida Travel Melbourne Florida